The 3 Pricing Strategies Every Seller Should Know

If your home didn’t sell the first time, or you’re thinking about listing soon, there’s one question that can make or break your entire experience: How do you price your home? Not “what’s it worth” on Zillow. Not “what you need to net” to buy your next home. Not even “what the neighbor’s house sold

Read More

5 Costly Mistakes Homeowners Make When Selling Their Home

If you’re thinking about selling your home, there’s a good chance you’ve already asked yourself the big question: What’s it worth? But the better question might be: What will it actually sell for? The truth is, how much money you walk away with doesn’t just depend on your home's condition or

Read More

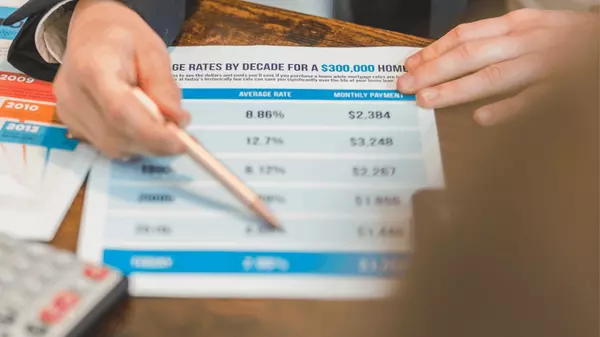

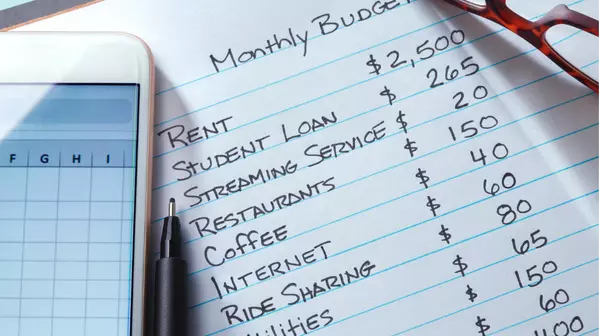

The New Rules of Homebuying: Budgeting for a House in 2025

For decades, buyers have been told to follow one simple rule: Don’t spend more than 30% of your income on housing. That is the gold standard. The budget benchmark. The line in the sand between “affordable” and “overextended.” But in 2025, that line no longer seems attainable. According to a Realtor

Read More

What’s Next for the 2025 Housing Market? Here’s What Experts Predict

Can you believe we’re already halfway through 2025? As we head into the second half of the year, a lot of buyers and sellers are asking the same thing: What’s next for the housing market? While no forecast is guaranteed, economists from Fannie Mae, Zillow, NAR, MBA, and others have released updated

Read More

Categories

Recent Posts