Thinking About a Move in 2026? Ask Yourself These Questions First

The end of the year has a way of slowing everything down. And for a lot of people, that creates space for a question that’s been sitting in the background for a while: “Should we make a move next year… or stay put?” If that thought has crossed your mind—even casually—you don’t need to decide anythin

Read More

6 Home Design Trends Shaping Buyer Decisions in 2026

Most homebuyers don’t walk into a house thinking about trends. The questions they’re asking are way more personal (and relatable): Will this space work for my life? Will I feel comfortable here? Will I regret this price six months from now? Buyers are balancing budgets and long-term plans, while

Read More

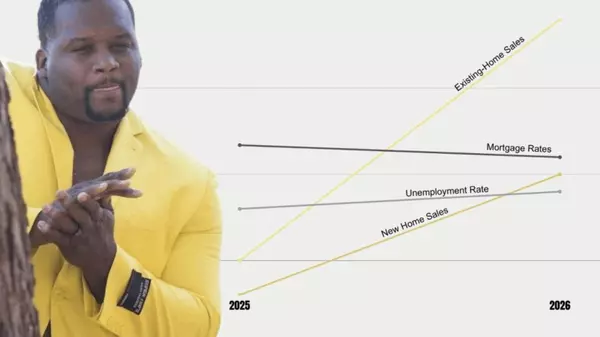

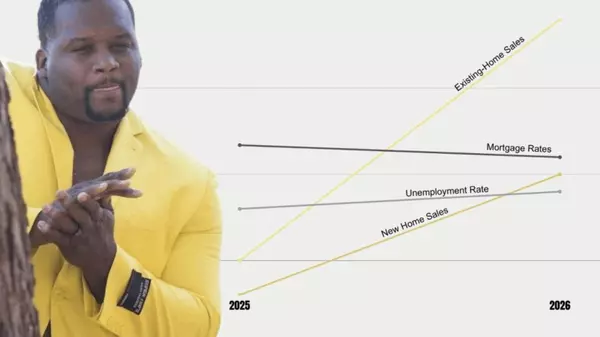

What Buyers & Homeowners Can Expect from the 2026 Housing Market

The 2026 housing market is already taking shape, and buyers and homeowners in Cedar Rapids are asking one big question: Will it finally get easier to make a move? The latest national forecasts from the National Association of REALTORS® (NAR), Realtor.com, and Zillow point to a slow but meaningful im

Read More

4 Housing Myths Debunked This Week: Here’s What the Data Actually Says

You would not believe how good it feels to take a scary headline about the housing market and present the actual data that makes buyers and homeowners visibly age in reverse. Take this week, for instance. If you have family over for Thanksgiving, you know how topics can range from the best time to

Read More

- 1

- 2

- 3

- 4

- 5

- 6

Categories

Recent Posts